How to use better data to build the best client relationships

How well do you know your clients? Probably, not as well as you should

In industries with very few client touchpoints, we know that it’s hard to get to know your clients. They may trust you with some of the most important transactions in their lives, yet you may barely know them at all.

Knowledge of your clients comes from having strong client relationships and, critically, strong data on your clients’ needs, habits and activities. These relationships are engineered by you, the business, and it’s down to you to orchestrate that relationship to provide you with timely, usable data.

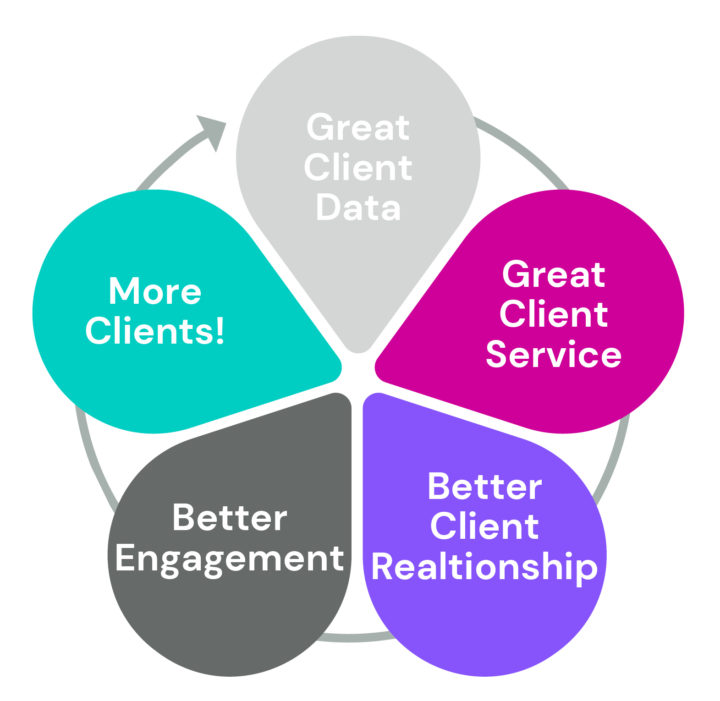

A virtuous cycle

Firstly, you must have a good strategy for getting the best data about your clients. That will allow you to run well-founded data analytics on your clients, fostering great insights that drive great service propositions for the best possible business relationships. It’s not an easy cycle to build or maintain, but it’s compelling and enticing and you may keep those clients for life.

Our real-life practical example

One of our clients has an ambitious client growth strategy. However, they had already identified that their data architecture, with its diverse silos, was hindering their ability to extract the best possible client insights.

Operational inefficiencies, limited analytical capabilities, and an expensive on-premise data centre were preventing them from delivering the cutting-edge and high-performing services they wanted.

6point6 was appointed to provide immediate and direct help into how to optimise the use of this extensive client data set. By applying our tried and tested methodology, we designed a coherent data architecture to efficiently link over 35TB [1] of data from more than 40 isolated data stores, spanning some 20 years.

Just to be clear here, by some calculations and research, that’s approximately the amount of data in 28 human brains, 7,344 DVDs or 15.4 billion pages of your favourite novel. [2]

Having managed that Herculean task, 6point6 designed and built a full, complete, well-organised and usable dataset. Our client now has the foundations to build far stronger relationships with their clients and deliver their services better, faster and more cheaply too.

Breaking bad data habits

As we mentioned above, to improve the quality of the data that you collect, you need to orchestrate better interactions with your clients.

If your client relationships are built mostly on low frequency, high value interactions – which is often the case in financial services – it’s likely you know very little about your clients. So, break that bad data habit as soon as possible.

Start by building more high frequency, low value interactions into your client journey. You’ll be able to stay in regular contact with your clients and build more data-rich relationships.

By improving the quality of your client relationships, you’ll improve the quality of your data. You may have to get creative with how you do this. Consider where you can build more touchpoints with your clients and ways for them to engage with your brand.

We’ve done it before, we will do it again

Interested in talking about this further? Get in touch.

Reference List:

[1] – https://www.redcentricplc.com/resources/byte-size-infographic/