How to automate claims in insurance

Many insurance companies are usually slower when adopting new technologies than other industries. As such, this means they are a bit behind on the digital transformation and automation journey. The complex processes in insurance mean it is sometimes difficult to attribute costs because of heavily manual, paper-based processes, leading to an expensive workforce, and many errors causing transaction failures. Questions like “what aspects of the claims process is costing the most time” are traditionally difficult to answer. The causes can be complex and the information about what is happening on the ground is not readily available. Highly manual processes often hide complexity and when examined the opportunities for automation become apparent.

Automating a personal injury claim

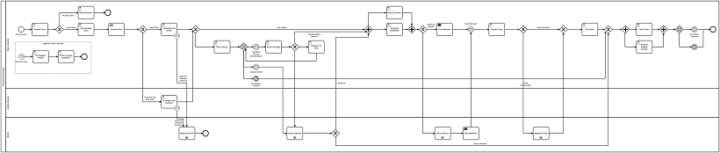

With a BPM solution in place, it is quite possible to visually see the inefficiencies or problems in a complicated process handled by many employees. As an example, we have taken a complex claim such as personal injury and created an automated, repeatable process having used Camunda BPM below. Using the design below, developers can convert this process into code. The automated workflow then guides users through a set of steps that can be more than one user and more than one user group. Importantly, this complex personal injury claim has now become a standardised, repeatable, and highly scalable process.

From this high-level view of the personal injury process, it’s possible to see the inefficiencies in the process and investigate them. This information allows us to capture critical data points enabling us to try different approaches and monitor the results creating transparency. This kind of insight is the first step to trimming the “fat” processes and operating a leaner and more focused team, department or company.

As data is gathered, we can introduce more complex automation that previously would have required human intervention to automate the decision points in the processes, where appropriate. Looking at the below example, there is an internal claims handler working for an insurance company where liability has been denied. At the event-based gateway, there are three potential outcomes: third party solicitor correspondence, litigation started, or no response received. At this decision point, Artificial Intelligence (AI) and Machine Learning are useful because there are so many factors to consider that humans can’t look up all the previous claims, the history of the solicitor, the claimant’s condition and whether life-changing injuries have occurred. AI and Machine Learning take process automation to its most advanced level with a further layer that automates the decision points in the system on the likely outcomes of certain scenarios.

Click the diagram to view in detail.

In summary, automation provides insights into daily operations are performed and needs to be implemented in a way that is intelligent using a hybrid of automation technologies. With this information, it becomes clear which areas of a process need to be targeted for automation and where the costs really are – highlighting those operational inefficiencies. The goal of automation is to provide you with the visibility over your business processes to save you money by automating in the right places.

Process automation from 6point6

6point6 offers superior process automation which delivers faster, highly scalable and automated decision making by automating your business processes using BPM, RPA and AI as depicted in our three-pillar solution:

Our approach to deploying automation at scale begins with an assessment. This is the analysis stage where we engage with your teams and senior management to understand your needs, goals and processes – both in terms of how they work now, and how you want them to work in the future. In this way, we can identify repeatable processes that can be automated and how automation might impact the rest of the company. Our assessment enables you to better understand what automation is needed, and you can use these findings with no obligations.